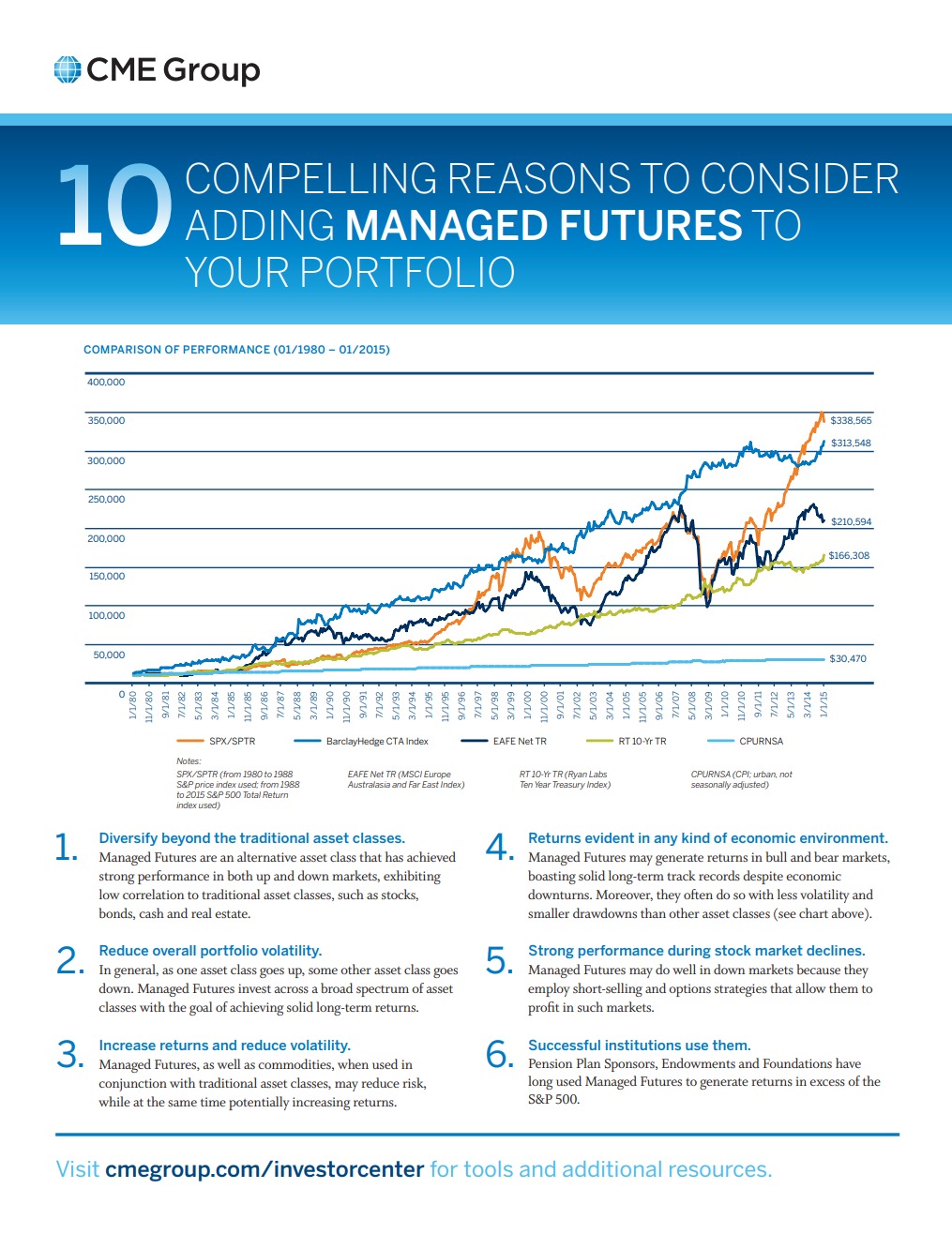

Managed Futures funds have a long history of providing returns independent of other financial markets and has historically done well in crisis periods for the stock market such as the 1987 crash, the Long Term Capital Management blow up in 1998, the tech stock bubble bursting in 2000, and the financial crisis in 2008.

They are alternative investments which rely on professional investment managers known as Commodity Trading Advisors (CTAs), who specialize in trading both long and short exchanged-traded futures contracts in markets across the world.

The Attainable Alpha fund has exposure to financial markets, including stocks, bonds and currencies. The fund also includes physical markets such as energy, metals, livestock, grains, and softs (coffee, sugar, cocoa).